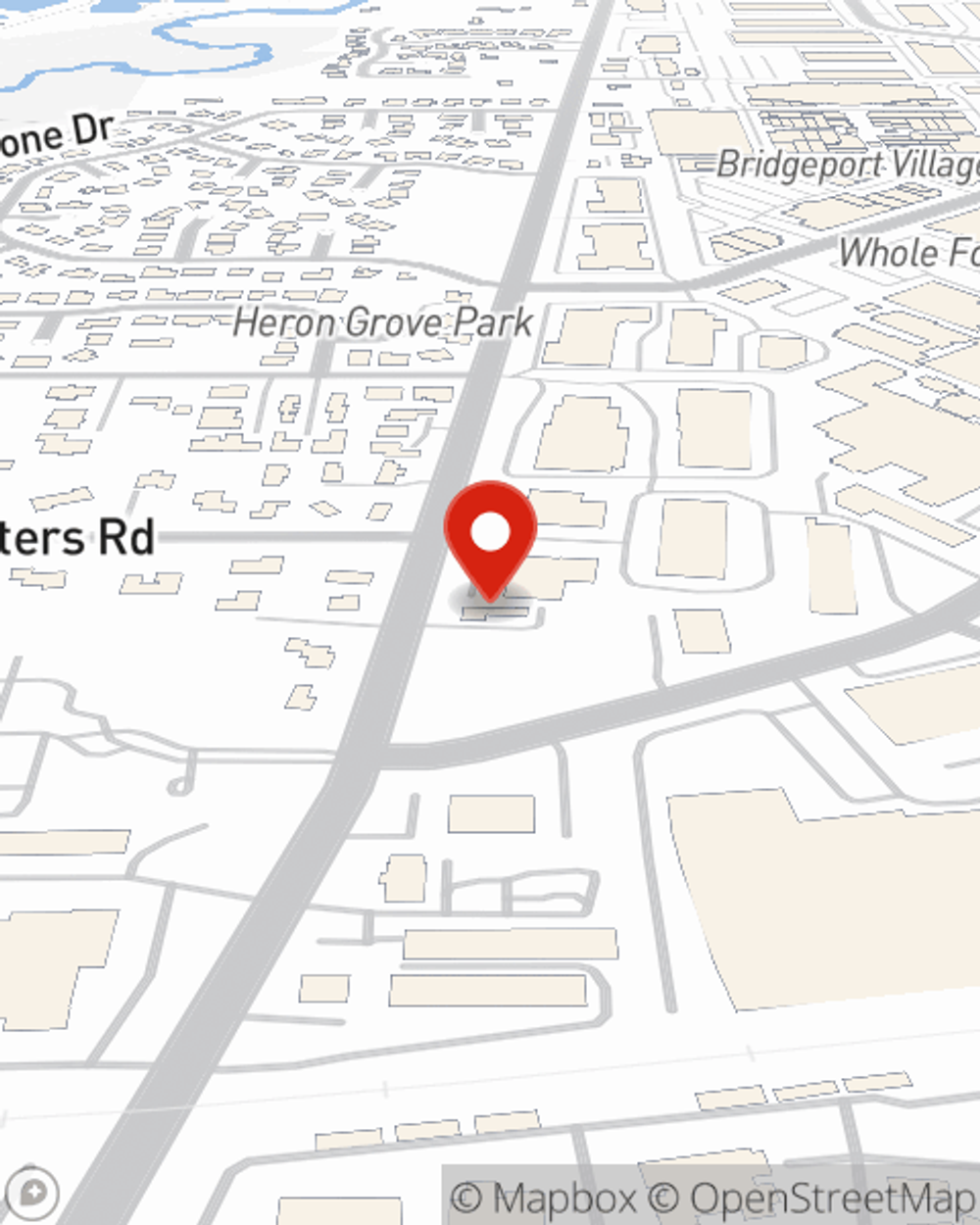

Business Insurance in and around Tigard

Researching coverage for your business? Search no further than State Farm agent Paul Barton!

No funny business here

Business Insurance At A Great Price!

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate catastrophe, like an employee getting injured on your business's property.

Researching coverage for your business? Search no further than State Farm agent Paul Barton!

No funny business here

Surprisingly Great Insurance

With options like extra liability, a surety or fidelity bond, business continuity plans, and more, having quality insurance can help you and your small business be prepared. State Farm agent Paul Barton is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Don’t let worries about your business keep you up at night! Get in touch with State Farm agent Paul Barton today, and discover how you can benefit from State Farm small business insurance.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Paul Barton

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.